Key highlights:

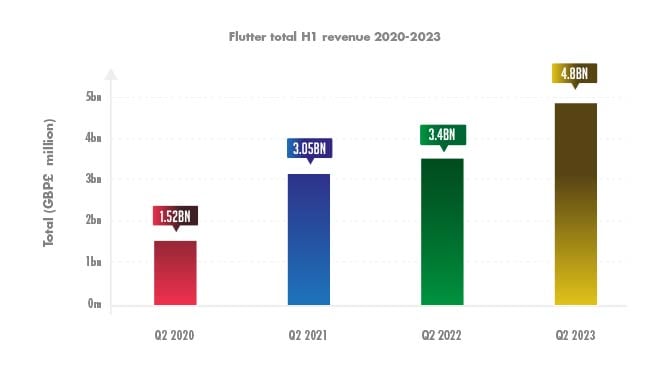

– Flutter sees revenue hit a four-year high of £4.8bn ($6.12bn)

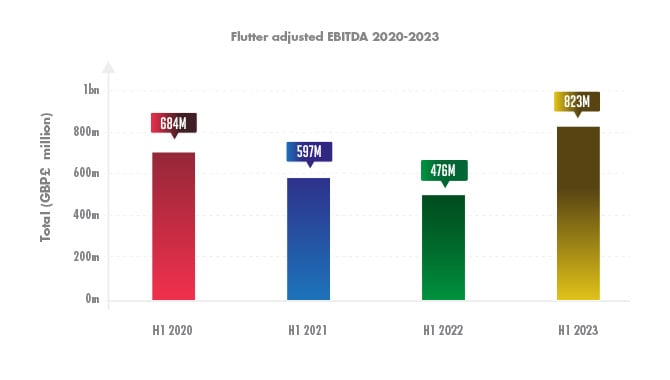

– Its adjusted EBITDA hits £823m

– However, net debt increases dramatically to £4.63bn

– Flutter’s market capitalisation stands at £25bn

Flutter’s significant increase in revenue, up to £4.8bn in H1 2023 from £3.4bn in H1 2022, was commented on by Flutter’s Chief Executive Peter Jackson: “The first half of 2023 marks a pivotal moment for the group, with our US business now at a profitability inflection point, helping transform the earnings profile of the group and significantly enhance our financial flexibility.”

Breaking down this revenue p, Flutter’s sports revenue rose 41% to £3bn – a division comprised of Flutter’s multiple sports betting brands, such as FanDuel and Sky Bet (among others).

Additionally, its Q2 ps show that its US sports betting division has a market share of 47%; FanDuel’s share of the sports betting market was quoted as 51% in Q2 2022. With new markets opening up in that time (such as Massachusetts), could this be cause for concern and suggest DraftKings and co. are catching up?

Meanwhile, back to revenue, Flutter’s gaming revenue also saw a similar percentage rise year-on-year at 43% – totalling £1.81bn.

Looking at Flutter’s total revenue since 2020 in the graph below, what can be seen is the company’s growth – which has more than doubled over the course of the last four H1 reports.

Concentrating on the US market, for H1 2023 Flutter’s sportsbook brands, FanDuel, the now closed Fox Bet and a couple of others, made £1.8bn over the first six months of the year – a 71% annual increase on H1 2022 – with this p predominantly comprised of FanDuel’s numbers.

Furthermore, Flutter’s US adjusted EBITDA for H1 2023 hit £49m – a significant improvement on the £132m loss it posted in H1 2022.

In the graph below, Flutter’s overall adjusted EBITDA hit £823m – a 73% increase year-on-year – compared to Flutter’s H1 adjusted EBITDA results since 2020.

What can be seen is the recovery of Flutter’s adjusted EBITDA, with it now reporting its highest EBITDA p since the dawn of the 2020s.

Looking at Flutter’s H1 gross profit, which totalled £2.8bn – an annual increase of 38% on H1 2022’s £2.04bn – it has steadily increased during the past four H1 reports, with H1 2020’s gross profit sitting at £1.03bn and H1 2021 posting £1.94bn.

The downside for Flutter in the report is that its net debt increased by 54% annually to £4.63bn. In its H1 2020 report, Flutter reported net debt of £2.9bn, a p that decreased to £2.7bn in H1 2021 and increased to £3bn in H1 2022.

Over the course of the year so far, Flutter’s share price has remained steady, while gently improving in general – with Flutter’s market capitalisation sitting at £25bn, at the time of writing.

On 3 January, it recorded a price of £114.50, with a yearly high of £167.25 coming on 22 May. At the time of writing, its price sits at £141.65, having dropped from £151.00 on 7 August.