Listen To Article

Listen To Article

Key stats

– Q3 revenue falls 1% to €586m

– EBITDA margin of approximately 24%

– Nine-month revenue increases by 4% to €1.88bn

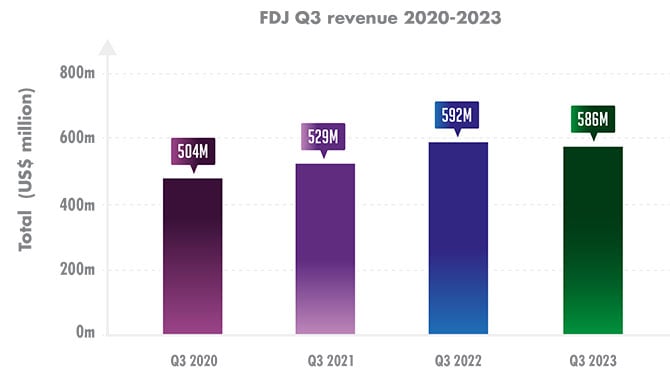

Looking first at FDJ’s revenue for Q3, the operator saw a marginal decrease from Q3 2022, recording €586m ($620.4m) against Q3 2022’s €592m. However, its Q3 2023 sum still represents a rise against Q3 2021’s €529m and Q3 2020’s €504m – as the graph below shows.

Breaking FDJ’s Q3 revenue for 2023 down further, its lottery sum made up the baulk of the overall p, with €449m. However, that has also fallen year-on-year; in Q3 2022, the company recorded €478m – representing a 6% decrease.

The division that saw the only annual rise was its sports betting and online gaming open to competition arm, which saw a 6% increase to €103m.

Moving to FDJ’s EBITDA, the company has stated that it expects its EBITDA margin to stay at ‘around 24%,’ though the French lottery operator opted against giving an exact p.

Meanwhile, FDJ’s stakes have fallen by 3% annually, now totalling €4.80bn against Q3 2022’s €4.95bn; however, its online stakes grew by 6% year-on-year to €679m.

Furthermore, Stéphane Pallez, Chairwoman and CEO of FDJ Group said of the results: “Our growth remains solid, with strong players’ demand, even though it has been affected by the low number of Euromillions high jackpot draws.

“At the same time, the completion of the acquisition of ZEturf at the end of September and the forthcoming closing of Premier Lotteries Ireland acquisition in November illustrate our strategy of internationalisation and diversification.”

Finally, FDJ’s share price, at the time of writing, is at €29.54, following a gradual downward trend in 2023 so far, with the high coming on January 27 at €40.80 – with a market capitalisation of €5.64bn.