Listen To Article

Listen To Article

DraftKings has posted its Q1 financial results, showing that it made $769.6m in total revenue – up 84% from 2022’s $417.2m.

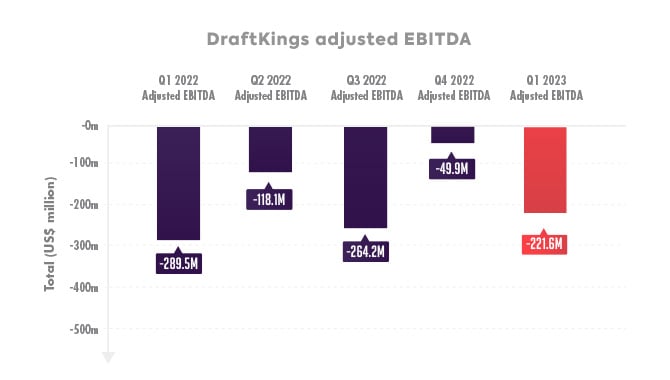

Meanwhile, its adjusted EBITDA sat at a $221.6m loss, an improvement over Q1 2022’s $289.5m. However, this is a trend that is frequently seen with DraftKings, as it drives significant amounts in revenue yet makes a loss due to its spending across the expanding US sports betting market.

The graph below shows DraftKings’ adjusted EBITDA over 2022 and 2023.

For Q1 2023, the company posted a net loss of $397.1m, better than the $467.6m – though CEO Jason Robins highlighted that the loss was part of the company’s long-term plan to achieve profitability.

Its loss per share also remained, totalling $0.51 – down from the $0.74 in Q1 2022.

Robins said of the results: “DraftKings’ first quarter performance – 84% year-over-year revenue growth and share gains underpinned by a relentless focus on operational efficiency – demonstrates that this is a company positioned for sustained success.

“We delivered highly successful online sportsbook launches in Ohio and our home state of Massachusetts and continued to create meaningful product differentiation driven by in-house innovations.

“We acquired customers faster and more efficiently and, importantly, saw healthy retention across cohorts. Looking at the remainder of 2023, I am confident DraftKings is well-positioned to achieve profitability on an adjusted EBITDA basis in the near term and deliver long-term value for our shareholders.”

Upon the release of the report, DraftKings’ share price remained steady at $21.38 – representing a solid incline over the past six months.