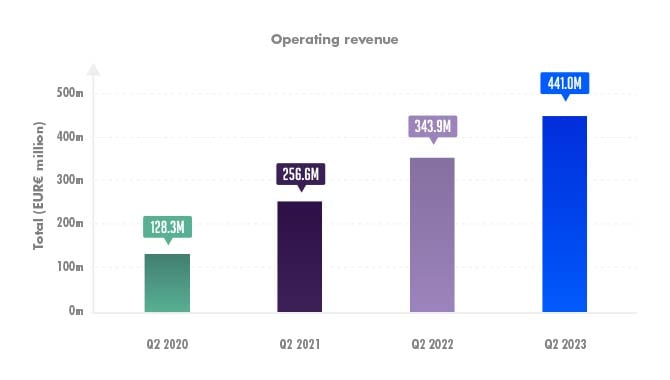

Evolution AB has posted its Q2 financial report showing that its operating revenue hit €441.1m – 28% up on the same period last year.

Breaking down its revenue, Evolution’s live brand made €93.3m more than in Q2 2022. However, its random number generators (RNG) only rose by €3.8m – behind the €72.9m heights of Q3 last year.

The incremental rise in RNG was addressed directly by the Evolution CEO, Martin Carlesund, in his comments, stating: “We have earlier communicated that the development towards our goal of double-digit growth will take more time and while not yet growing in line with our targets for RNG, it is worth pointing out that it is a highly profitable business and accretive to group margins. I expect the year-on-year RNG growth to improve in the coming quarters this year.”

Below is a chart that shows Evolution’s Q2 operating revenue since 2020, which shows a slowing of the increases year-on-year to Q2 2023.

Furthermore, Evolution’s EBITDA increased to €311.7m, 31% higher than Q2 2022. Over the past four Q2 results, much like its operating revenue, its EBITDA has notably slowed in 2023 – with its 31% growth comparing poorly to its Q2 2020 through Q2 2021’s 115% rise.

Additionally, Evolution’s EBITDA has hit the highest EBITDA margin of any quarter for the company in its history at 71%.

Moving to Evolution’s operating profit, it too showed a slowing annual increase, with the report showing it totalled €281.5m against Q2 2022’s €214.5m – an increase of 32%.

In the past year, Evolution’s share price has steadily increased, peaking at SEK 1,449.00 ($139.73) on 2 June. Meanwhile, at time of writing, the price sits at SEK 1,273.60, significantly higher than the SEK 893.40 it recorded on 21 July 2022. However, it slightly fell after these results.

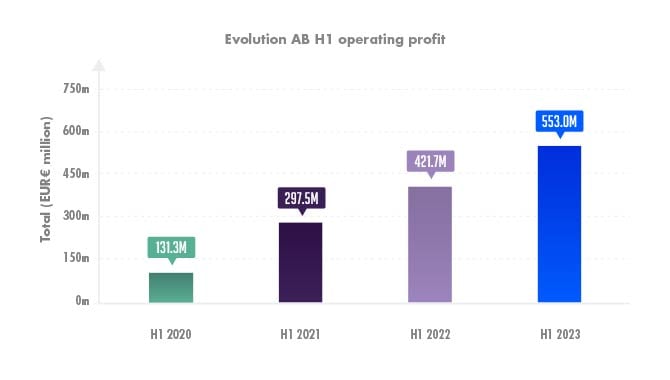

For H1 2023, Evolution’s operating revenue has shown that it is 30% higher than Q2 2022, making €870.6m against €670.7m. For Q1 2020, the company’s operating revenue in H1 stood at €243.4m, which grew by 102% year-on-year in H1 2021 to €492.5m. That p’s growth then slowed annually in H1 2022 to total €670.7m, rising 36%.

The graph below shows Evolution’s rises in operating profit since 2020, compounding the trend seen through Evolution’s fiscal performance in the last four years.

What can be seen in Evolution’s results is a slowing of the vast growth it has shown in recent years, though most ps remain growing at a circa-30% rate.

These ps are strong, yet Carlesund’s comments come tinged with a sense of lost opportunity, in which he stated: “Although a strong financial result, operationally I feel that we can do more to leverage our execution power to the fullest.”